Budget 2024 strikes gold for the gems and jewellery industry! We applaud the government’s decision to slash customs duties on gold, silver, and platinum to 6%, 6%, and 6.4% respectively. This was indeed long-awaited. This will help businesses of all scales grow as consumers will also reap the rewards, with increased savings and a renewed interest in gold investments. A significant win for the industry. A game changer for the industry at large.

Benefits of joining our Gem & Jewellery institute, especially in light of the recent reduction in customs duty on Gold and Silver:

- Access to Premium Materials: The lower cost of gold and silver means you can afford to use high-quality materials more frequently, enhancing your learning and allowing you to create professional-grade pieces.

- Affordable Prototyping: You can experiment and create multiple prototypes without the financial burden of high material costs, allowing you more exploration and innovation.

- Enhanced Learning Resources: The savings from reduced customs duties are reinvested into better tools, equipment, and materials, ensuring that you have access to the best resources available for your education.

- Portfolio Development: Students can create a diverse and high-quality portfolio using gold and silver, which is crucial for showcasing their skills to potential employers or clients.

- Business Opportunities: For aspiring entrepreneurs, the ability to work with gold and silver at lower costs means they can start their jewellery lines more affordably, with lower initial investment requirements.

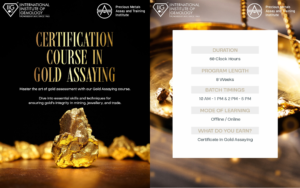

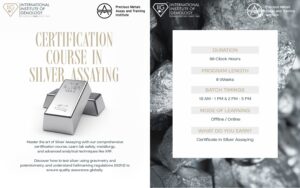

Enrol now for a Practical and Comprehensive Education in Gem & Jewellery with the newly launched Gold Assaying and Silver Assaying courses in collaboration with PMATI – WGC

Enrol now for a Practical and Comprehensive Education in Gem & Jewellery with the newly launched Gold Assaying and Silver Assaying courses in collaboration with PMATI – WGC